–News Direct–

By Meg Flippin, Benzinga

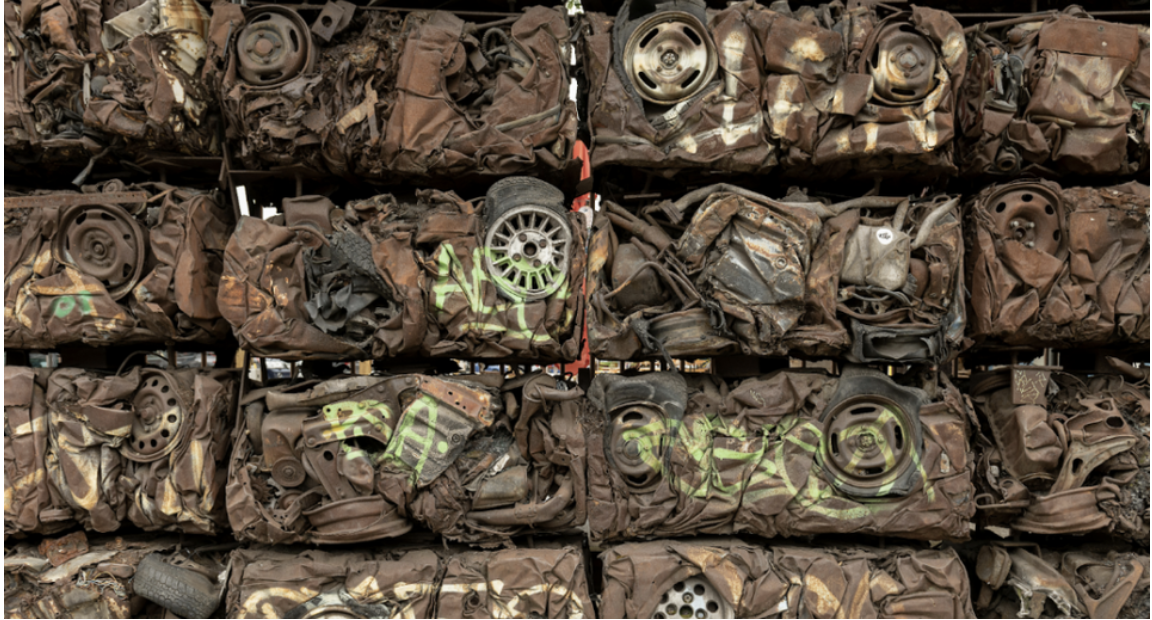

Somebodys garbage is another persons treasure couldnt be truer when it comes to recycling steel. Unlike plastics and other materials, steel can be melted and recast over and over to be made into new things. It could be the chassis of a vehicle one day and melded into beams for a skyrise the next.

Using recycled steel instead of new material can cut related CO2 emissions by about 75% as it uses about 70% less energy than manufacturing new materials. As a result, its not surprising that recycled steel is in demand as the world moves toward a greener future. As it stands, two out of every three tons of steel produced come from recycling. In 1980 it was just one out of every ten tons produced.

Recycled Metal Driving Growth

It's also big business. In 2019, the metal recycling market was valued at $52.1 billion and is projected to reach $76.1 billion by 2025, growing at a CAGR of 7.8% during the forecast period. That growth opportunity hasnt been lost on Greenwave Technology Solutions Inc. (NASDAQ: GWAV), the operator of 13 metal recycling facilities in Virginia, North Carolina and Ohio. It also operates Scrap App Inc., a wholly owned subsidiary that created an AI-based quoting system for metal from construction and demolition projects, lists the nearest scrap yards with their real-time pricing and has a points-based rewards system. The unit has generated over $200,000 in revenue within its first 130 days of operations, with Scrap App capturing market share for end-of-life motor vehicles in the Hampton Roads, Virginia and Cleveland markets, says the company. Greenwave has plans for the unit to expand into other strategic markets soon. Peddle, a competitor to Scrap App, has an annual revenue of around $159 million, underscoring the opportunity for the company. Radius Recycling Inc. (NASDAQ: RDUS), another competitor to Greenwave sports a market capitalization of about $540 million.

Business Growth

Since its inception, Greenwave reports that it has witnessed growth, with the company generating $18.46 million in revenue and $1.23 million in cash flow from operating activities in the six months ended June 30, 2023. The company is currently in growth mode, aggressively expanding its footprint of recycling locations by acquiring independent, profitable scrap yards across the country. The company reports that the market is highly fragmented and ripe for consolidation. When it comes to bolt-on buys Greenwave is committed to not overpaying and is focused on pursuing deals that dont have a lot of dilution or impact cash flow. The companys goal is to utilize sellers notes as its preferred form of consideration as it expands.

Greenwaves Scrap App

Greenwave recently announced that its wholly-owned subsidiary, Scrap App, launched new AI-powered features to optimize pricing and sales. In a recent press release, Greenwave stated that the company anticipates Scrap App's planned national expansion, coupled with its AI strategy, will accelerate growth.

Greenwave Chairman and CEO Danny Meeks stated "We plan to expand Scrap App to multiple new markets across the United States in the coming weeks. As a technology platform, Scrap App has the ability to scale to new markets with minimal capital investment we do not have to open a new facility, purchase additional equipment, or significantly expand overhead when we enter a new city. We believe Scrap App has the potential to generate significant, high-margin revenue and create value for Greenwave shareholders."

Building A Better Recycling Plant

The companys recycling facilities collect, classify and process raw scrap metal both ferrous and nonferrous, and then apply in-house technologies to increase metal processing volumes and operating efficiencies such as a downstream recovery system and a cloud-based ERP system. To boost efficiency and thus sales, the company recently began operations of a metal baler, wire stripper and three sheers at its non-ferrous processing facility in Portsmouth, Virginia. The high-capacity metal baler is capable of compacting large amounts of metal into dense bales significantly reducing the amount of labor and cost required to process, transport and sell copper and aluminum products, says Greenwave. By condensing more material into each load of metal it sells, the company should be able to reduce transportation costs and realize a greater profit margin. It will also make it easier to export its products to domestic and international clients, potentially increasing the revenues generated by its products.

Greenwaves Second Shredder

Greenwaves customers include large corporations, industrial manufacturers, retail customers and government organizations. Earlier this month, Greenwave announced Dominion Energy Inc. (NYSE: D) is in the process of connecting Greenwaves second automotive shredder to the power grid with operations expected to commence shortly after that, doubling Greenwaves annual shredded ferrous output. It's the second Greenwave automotive shredder an American Pulverizer 60×85 connected to the power grid. By shredding the steel Greenwave sells unshredded, the company expects to generate about 25% to 30% more revenue with significant margins on that steel volume, putting the company on track to achieve what it says are record revenues and record volume of steel processed this year.

Greenwaves second shredder provides the infrastructure for us to expand our footprint of metal recycling facilities up from 13 currently significantly growing Greenwaves revenues, margins, and free cash flow, CEO Danny Meeks said. We believe the market is significantly undervaluing Greenwave and firmly believe that by continuing our hub-and-spoke strategy of shredder hubs with feeder yards, we will become an increasingly attractive acquisition target of the major scrap metal conglomerates.

Growth Across Markets

But its second shredder isnt the only growth driver for this recycling company. Greenwave, which also operates under the Empire Recycling moniker, reports that it is seeing strong growth from its Virginia Beach and Cleveland scrap yards, with revenue, volume and profits all growing. That, says the company, puts it in a good position to become a leader in both markets in the not-too-distant future. It doesnt hurt that the company has successfully restructured its senior secured debt, enabling it to operate the second auto shredded in Carrollton. Virginia, which is scheduled to be connected to the power grid by April 9.

Recycling metal is a growing business and is only expected to grow as companies, government entities, cities and even countries look for ways to lower their emissions. Greenwave Technology Solutions recognizes that and is positioning itself for what could prove to be long-term growth as it snaps up its scrappier rivals and expands into new markets.

Featured photo by v2osk on Unsplash.

Benzinga is a leading financial media and data provider, known for delivering accurate, timely, and actionable financial information to empower investors and traders.

This post contains sponsored content. This content is for informational purposes only and not intended to be investing advice.

Contact Details

Benzinga

+1 877-440-9464

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/greenwave-technology-solutions-could-be-emerging-as-recycling-leader-by-increasing-metal-processing-capabilities-in-eastern-u-s-951411191

Benzinga

COMTEX_449970187/2655/2024-03-28T08:36:46

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Atlas Story journalist was involved in the writing and production of this article.